Mortgage Rates Might See Relief in September, but That Depends on the Fed

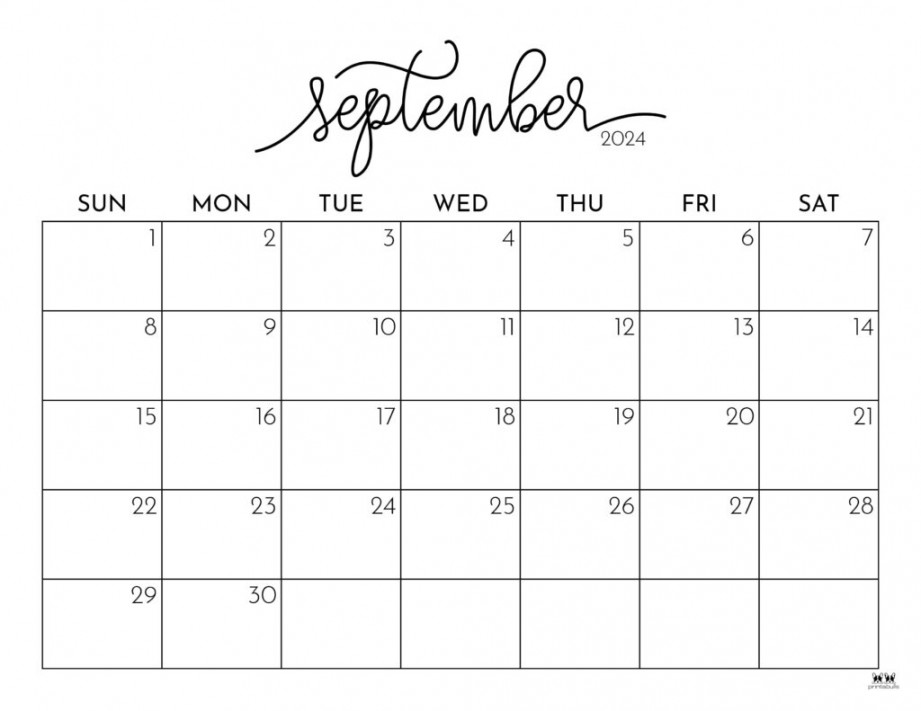

The Federal Reserve might have the confidence to cut interest rates in September. That was my takeaway from Fed Chair Jerome Powell’s remarks after the central bank announced its decision to keep interest rates where they are this week.

But forecasts change all the time. As Powell himself underlined: “Certainty is not a word we have in our business.”

Though the Fed has made progress on slowing the economy, it’s not ready to lower interest rates yet. That means overall borrowing costs, including for mortgages, will continue to be expensive. Since the central bank began hiking rates to tame inflation, the cost of purchasing a home has risen significantly.

Following this week’s Fed meeting, Powell pointed to the “significant hardship” of high inflation, but I noticed he made no mention of the housing market. Steep home loan rates have made homeownership unaffordable, and prospective homebuyers are eager to see some mortgage rate relief.

‘Fed speak’ matters for mortgage rates

When the Fed speaks, financial markets listen. And mortgage rates, which are influenced by investor expectations and bond yields, move too.

Experts tell me there’s a growing case for the Fed to lower rates in September. Inflation is improving and the labor market is weakening. In fact, the expectation for a rate cut has already been priced into the mortgage market, which explains why we saw mortgage rates dip following weak labor and inflation readings in June.

From my observation, it seemed to be the first time the Fed has given a more hopeful timeline for its first rate cut since 2020.

“The time is approaching. And if we get data we hope we get, a reduction in the policy rate could be on the table in the September meeting,” said Powell.

To be clear, one single rate cut won’t be a magic cure for the housing market. Mortgage rates won’t plummet immediately, housing supply won’t instantly recover and home prices won’t suddenly become affordable. But a multiyear process of easing interest rates across the board could help move the housing market out of its current paralysis.

There’s always a caveat though. “The markets move on expectation, not always fact,” said Nicole Rueth, SVP of the Rueth Team Powered by Movement Mortgage. Since today’s mortgage rates already reflect the anticipation of a September rate cut, financial markets will be upset if it doesn’t actually happen.

Powell drove home the message that any future policy changes will depend on “incoming data, the evolving outlook and the balance of risks.” If economic data comes in worse than expected (i.e., inflation stagnates), it could shift market expectations for a September rate cut and put mortgage rates back on the incline.

I can’t say I haven’t heard that before.

Subscribe

Even with high rates, homebuyers have options

At some point, prospective buyers will get tired of being sidelined and sellers won’t be as determined to hold on to their homes. That pent-up demand and tight inventory in the housing market is likely to rupture.

On paper, today’s housing market is definitely unaffordable. But many experts have told me recently that it’s not a bad time to purchase a home, per se.

“Today’s market is giving buyers the biggest opportunity for more inventory choices and negotiation power,” said Rueth. As rates decline, homebuying demand will increase significantly and buyers will lose that advantage, she said.

Another benefit of buying today is that you can always refinance your mortgage later when rates come down, said Greg Sher, managing director at NFM lending. Home prices tend to appreciate every year. So, if you delay purchasing until mortgage rates improve, you’ll likely be met with higher home prices that eat away at your savings, Sher said.

If it makes sense for your budget, it’s worth exploring what’s on the market now.

Recommended Articles How the Federal Reserve Affects Mortgage Rates in 2024 How the Federal Reserve Affects Mortgage Rates in 2024 Inflation Data Is Promising for Mortgage Rates. What Homebuyers Should Know Inflation Data Is Promising for Mortgage Rates. What Homebuyers Should Know Home Sales Are Slow. Does This Mean Housing Prices Will Go Down? Home Sales Are Slow. Does This Mean Housing Prices Will Go Down? Mortgage Rate Predictions for Week of July 29–Aug. 4, 2024 Mortgage Rate Predictions for Week of July 29–Aug. 4, 2024 Mortgage Rates Aren’t the Only Hurdle for Homebuyers. There Aren’t Enough Houses Mortgage Rates Aren’t the Only Hurdle for Homebuyers. There Aren’t Enough Houses You Won’t Get a 2% Mortgage Again. How to Adjust to a Different Housing Market You Won’t Get a 2% Mortgage Again. How to Adjust to a Different Housing Market